If you’ve been following the blog, then you know that I’m all about budgeting.

For me, it’s more than being smart with my money – it’s a lifestyle that allows me to be comfortable and make life-impacting decisions in moments.

Budgeting can be time-consuming and a lot of work, but keeping tabs on my finances has impacted my life for the better – it’s worth every minute that I devoted to it

With a little push in the right direction, perhaps you too can stay on budget and reach financial stability.

These are the 5 steps that have helped me the most with budgeting – follow them and you will be on a great path to staying on budget.

Strategy #1: Track with a Budgeting Spreadsheet

Don’t be intimidated by spreadsheets – they will automate calculations and visually display where you stand on your budget.

I log all my expenses and earnings in a spreadsheet which I update religiously. Every expense, no matter how small, is added to my tracking sheet.

That way, I can accurately review how I’m doing month-to-month in terms of budgeting.

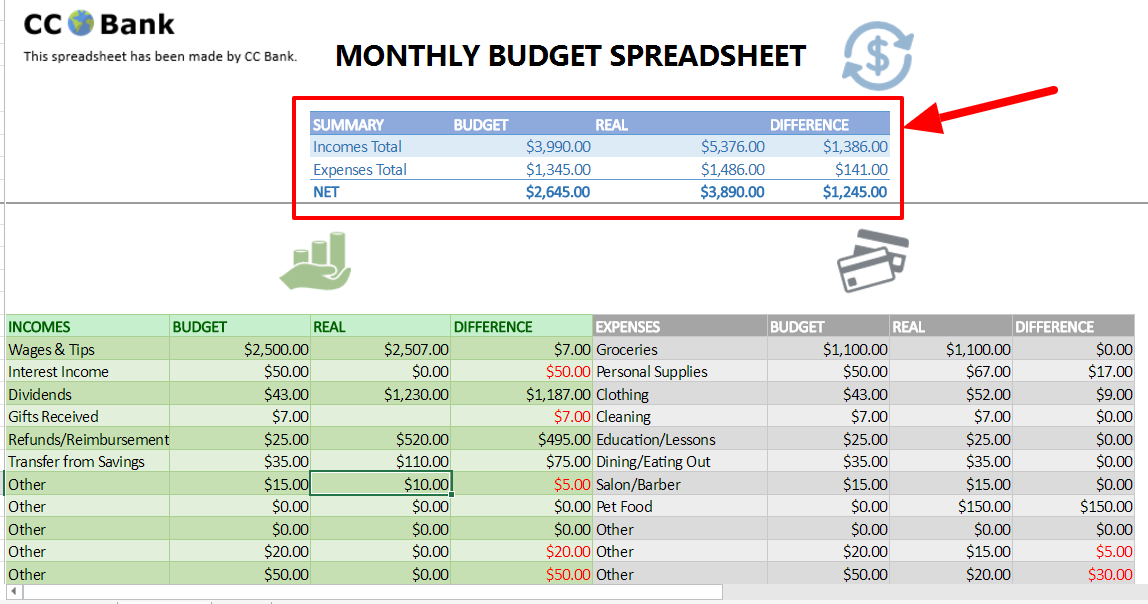

If you’re looking for a ready-made spreadsheet, CC Bank has a great free monthly budget spreadsheet for download (they have great tips there, too).

How to use the CC Bank spreadsheet:

- Fill in the “BUDGET” columns on either side of the table. For the green, add any expected income like salaries, gifts and dividends. For the grey, add your desired budget for different expenses.

. - As the month moves forward, update the columns that say “REAL” with real numbers to showcase your real expenses and income.

. - Throughout the month, check how your income and expenses compare to your budget. Are you exceeding your groceries’ budget too early in the month? Are you earning less than you thought?

. - At the end of each month, see the greater picture by looking at the summary on top (marked in red above). Where do you stand in your monthly budget? Ideally, you’re estimates are on point.

. - Evaluate necessary readjustments to your budget for the next month, or perhaps set up goals for yourself, like cutting back on certain expenses. Read the next step to go into more detail about this.

.

[button url=”https://ccbank.us/blog/monthly-budget/” target=”blank” background=”#ef2d78″ size=”4″ center=”yes” radius=”0″ icon=”icon: download”]Get the Monthly Budget Spreadsheet[/button]

.

As time goes by, you will learn more about your spending habits and how you can readjust them to reach your financial goals.

Strategy #2: Analyze and Readjust Your Spending

With today’s use of credit card transactions and internet purchases, we don’t feel the weight of purchases as strongly as when our wallet empties of cash, so it’s easy to lose track of expenses.

Look through your budget and analyze how you’re doing: are there expenses that can be cut? Alternative services that could be more affordable?

Even cutting small conveniences like the purchase of a daily coffee can have a major impact on your savings. Instead, make coffee at home or at work and save the money.

Here are some of the changes I made over time to reach my desired budget:

- Ride my bike to work instead of driving

- Cut all sodas from my diet

- Switched to more affordable cell phone and internet plans

- Re-negotiated my bank fees

- Cancelled unnecessary credit cards

- Here are a few other ideas on what to cut

Don’t feel overwhelmed by the need to readjust expenses – the challenge of saving becomes exciting!

Strategy #3: Pre-plan All Purchases

The best way to stay on-budget is to stick to lists and plans of what to buy.

Even if it seems unnecessary, every shopping outing should include a purchase list so you can be laser-focused. It’s easy to be tempted by other products.

Consider preparation a new habit: each time you need to shop, write a list of what you need and most importantly, stick to it.

This goes for grocery food, household items, gas, hardware stores, laundry services and clothing.

Pre-planning also has other aspects: studies show you should never shop hungry – it results in purchasing extra food you didn’t include in your grocery list.

So eat before grocery shopping!

Strategy #4: Enjoy the Smaller (and Free) Things in Life

I understand that budgeting can be difficult on social life and even on relationships.

However, being budget-conscience doesn’t mean you can’t enjoy going out. Instead, you need to pick budget-friendly activities.

There are so many enjoyable activities you can do for free or low-cost:

- Walks in the beach, parks or town

- Free concerts and activities sponsored by your town/city

- Free museum days

- Game night

- Volunteer somewhere

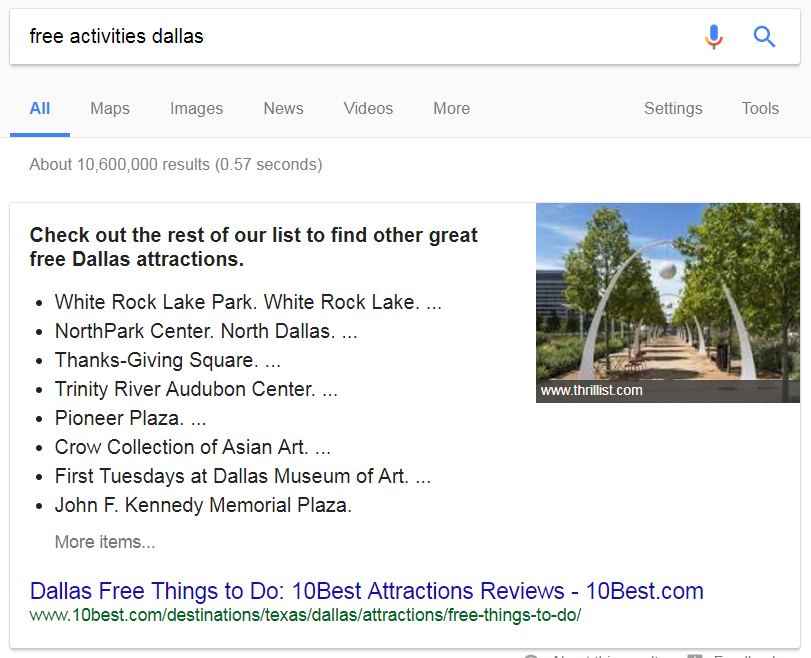

Do a quick Google search to find free activities in your area – you’ll be surprised by the number of options available.

By reallocating your time to these activities, you’re saving money while still keeping yourself entertained and distracted.

And if ever you need to treat yourself to something a bit pricier, do it, but do so sparingly.

Strategy #5: Live Below Your Means, not Above

Time and time again, articles discuss how the rich live below their means.

For those of us bombarded by Instagram photos of wealthy people showing off material possessions, that may sound unbelievable.

In reality, most wealthy people are not flaunting their money and are instead, frugal and thoughtful with their purchases.

The reason many well-off people are living well is because they live below their means – they are not upgrading to new homes, new cars and new partners as their income increases.

Thus, they are saving their earnings and living securely, rather than spending more.

Many people (rich and poor) have the unfortunate habit of spending money they don’t have, falling into a black hole of debt.

Don’t spend frivolously – buy what you need and what falls within or below your means; focus instead on killing off debt and increasing your savings.

![]()

There is no magic trick to following a budget; it takes dedication, time and learning.

But in the end, it’s fully worth it — there’s no feeling of security like seeing your savings add up and debt decrease.

How do you stay on-budget? Share your tips below!

Thanks to Freepik for the original version of the featured image and background.

Great tips that will definitely help me. I really need to adjust my budget to save for some big expenses.

Absolutely love this article! Honestly, I’m having a hard time to stay on a budget. Now I learn from this a lot! I’m really thankful that you shared these brilliant tips!

My Mum has always taught me to live below my means, and this one really works for me. However, there are instances when I do go off the budget like when someone in the family gets sick. 🙁

What an amazing compilation of points to stay on budget. I need to pre-plan my purchases instead of impulse buying thinking that I might need that thing. Also, using a spreadsheet to enter the expenses is a great way to track the expenses and budget.

That’s what I teach and say to my daughter that live below your means, and its really works for us, and another one I need to Pre-plan our purchased. I will definitely shared this to my friends.

we should save our earnings rather than flaunting..we should spend as per our limit not by looking rich ones.Very informative tips you have given to maintain budget. this will be very helpful fo rmiddle class.